Profitable

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

Quick and simple, without the hassle. Instant fund transfers with extended loan options

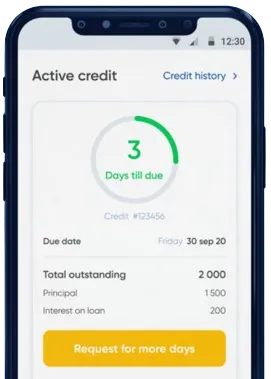

Make your request in the app, just complete the form.

Anticipate our decision, made swiftly in 15 minutes.

Collect your money, with transactions often completed in one minute.

Make your request in the app, just complete the form.

Download loan app

Payday loans are a type of short-term loan that can provide quick and easy access to cash when you need it most. These loans are particularly popular in South Africa, where many people rely on them to cover unexpected expenses or bridge the gap between paychecks.

One of the main benefits of payday loans online in South Africa is their convenience and accessibility. With online payday loans, you can apply for a loan from the comfort of your own home or on the go, using just your computer or smartphone. This means you can avoid the hassle of visiting a physical lender and can get the money you need quickly and easily.

This makes payday loans online a great option for those who need money fast and don't have time to wait for a traditional loan approval process.

Another advantage of payday loans online in South Africa is the flexibility they offer in terms of repayment. Many lenders allow you to choose the loan amount and repayment period that best suits your needs and budget. This can help you avoid falling into a cycle of debt and make it easier to repay the loan on time.

Additionally, some payday loan lenders in South Africa offer installment loans, which allow you to repay the loan in smaller, more manageable payments over a longer period of time. This can be especially helpful if you need to borrow a larger amount of money or if you have difficulty repaying the loan in one lump sum.

Unlike traditional loans, payday loans online in South Africa typically do not require a credit check. This means that even if you have bad credit or no credit history, you can still qualify for a payday loan. This makes these loans a great option for people who have been turned down for loans in the past or who have less-than-perfect credit.

Some lenders may require proof of income or employment to ensure you can repay the loan.

Payday loans online in South Africa can provide much-needed financial assistance in times of emergency or unexpected expenses. Whether you need to cover medical bills, car repairs, or other unforeseen costs, a payday loan can help you bridge the gap until your next paycheck.

However, it's important to use payday loans responsibly and only borrow what you can afford to repay. Be sure to read the terms and conditions of the loan carefully and understand the fees and interest rates involved before borrowing.

Overall, payday loans online in South Africa can be a useful and practical financial tool for those who need quick access to cash. With their convenience, flexibility, and accessibility, these loans can provide a temporary solution to unexpected expenses or financial emergencies. Just remember to borrow responsibly and only take out a loan if you can afford to repay it on time.

A payday loan online is a short-term loan that you can apply for and receive online. These loans are typically used to cover unexpected expenses or financial emergencies.

When you apply for a payday loan online in South Africa, you will need to provide some basic information about yourself, such as your ID number, proof of income, and bank account details. Once approved, the funds are usually deposited directly into your bank account.

Typically, you will need to be a South African citizen or permanent resident, be over 18 years old, have a regular source of income, and have an active bank account. Some lenders may also require a good credit score.

The amount you can borrow with a payday loan online in South Africa will vary depending on the lender and your individual financial situation. Typically, amounts range from R500 to R8000.

Interest rates and fees for payday loans online in South Africa can be high, so it's important to carefully read and understand the terms and conditions before accepting a loan. Make sure to compare rates and fees from different lenders to find the best deal.

Once approved, the funds from a payday loan online are typically disbursed within 24 hours, although some lenders may offer same-day funding options.